In recent years, Wirehouse stockbrokers have consistently been critical of annuities, particularly fixed indexed annuities (FIAs). The narrative they present paints annuities as costly, inefficient, and unsuitable for modern investors. But the truth is that this narrative is not only misleading, but it’s also an outdated perspective that fails to account for significant advancements in annuity products. At its core, the objection that annuities are “too good to be true” stems from an inherent bias: Wirehouse brokers, driven by an incentive structure that thrives on advisory, portfolio, and trading fees, view annuities as a threat to their business model.

In this article, we’ll examine why Wirehouse stockbrokers have got it wrong about annuities, and how fixed indexed annuities, in particular, offer superior benefits that often outperform traditional bond portfolios.

1. The Wirehouse Model: A Focus on Asset Management Fees

Wirehouse stockbrokers—those employed by major investment banks and wealth management firms—typically earn their income from a combination of advisory fees, trading commissions, and asset management fees. These fees often reach 2% or more annually, not including hidden costs like expense ratios in mutual funds or transaction fees for trades. Given their structure, Wirehouse brokers have a vested interest in keeping as much money under management as possible, which translates into keeping clients’ funds in stocks, bonds, and mutual funds, generating consistent fees for the broker-dealer.

Annuities, on the other hand, are a different story. Because they are designed to be long-term, income-generating contracts, they don’t require ongoing asset management. Once you invest in a fixed indexed annuity, it’s essentially “set and forget.” This means that brokers have less incentive to recommend annuities, as these products do not generate the same level of ongoing revenue for them.

Additionally, Wirehouse stockbrokers have consistently misrepresented annuities, claiming that they are too good to be true. But when you look at the numbers, you’ll see that the real question is, why would a broker continue to recommend the very products that have failed to deliver results—especially in bond portfolios—when annuities offer something far superior?

2. Annuities vs. Bond Portfolios: The Performance Battle

For decades, the go-to investment for conservative clients has been bond portfolios. In theory, bonds are considered a safe investment, providing regular income while preserving principal. But in recent years, bond portfolios have drastically underperformed, particularly in the face of rising interest rates and market instability. Let’s take a closer look at how bond portfolios and fixed indexed annuities (FIAs) compare.

In a study from my book Annuity 360, I compared two portfolios: one consisting of a traditional bond portfolio with 60% stocks and 40% bonds, and another featuring a fixed indexed annuity with the Barclays Atlas 5 Index. Both portfolios started with $1,000,000 in initial capital.

In 2020, Moody’s BAA Index (the bond index) performed at a rate of return of just 3.32%, while the SILAC Denali Bonus 10 fixed indexed annuity with the Barclays Atlas 5 Index linking grew at 6.99%. That’s a substantial difference, especially considering that the FIA didn’t expose the investor to any market risk.

3. FIA vs. Bond Portfolio After 35 Years

When we extend the timeline to 35 years, the performance gap widens even further. Here’s a comparison between the bond portfolio and the FIA over that period:

- Bond Portfolio Value After 35 Years: $1,333,436.18

- FIA Value After 35 Years: $4,187,610.53

The FIA outperformed the bond portfolio by a staggering $2,854,174.35. This is not a one-time occurrence; the trend is consistent: FIAs outperform bonds over the long term, and they do so without the same level of market risk.

Moreover, in this example, the FIA saved the investor approximately $210,000 in fees over the 35-year period by eliminating the need for advisory and portfolio management fees. This is the reality that Wirehouse stockbrokers want to ignore. Instead of acknowledging this reality, they focus on the negative narrative of annuities being expensive and risky. The truth is, traditional bond portfolios—often pushed by these very brokers—have failed to deliver on their promises for the last decade.

Source: Vertical Vision Financial Marketing Finance Department, in an attempt for fairness with this calculation, we selected 3.5% which is .18% higher than Moody’s BAA Bond Yield in 2020 of 3.32%. https://ycharts.com/indicators/us_coporate_aaa_effective_yield#:~:text=Basic%20Info,long%20term%20average%20of%204.11%25.

4. The Truth About Annuity Fees: Low, Transparent, and Effective

One of the key criticisms leveled against annuities is their fee structure. Critics claim that annuities come with high fees, but this argument is based on outdated information. It’s time to set the record straight.

Let’s compare the fees associated with Wirehouse investment products (stocks, mutual funds, and bonds) with those of fixed indexed annuities:

Wirehouse Investment Fees:

- Advisory and Portfolio Fees: 1%–2% annually.

- Expense Ratios: 0.4%–1.0% for mutual funds.

- Trading Fees: 3 to 5% per trade when stocks or bonds are bought and sold.

- Hidden Fees: Brokerage commissions, administrative costs, and transaction fees that are often not fully disclosed to clients.

Fixed Indexed Annuity Fees:

- No Advisory or Portfolio Fees: Once the annuity is purchased, no ongoing fees are deducted from the account.

- Income Rider Fees: If added, these are typically much lower than portfolio management fees and are designed to offer guaranteed income in retirement.

- Administrative Fees: Very low and transparent, typically ranging between 0.25% and 0.5%, depending on the annuity product.

In many cases, the overall fees associated with annuities are much lower than those of Wirehouse investment products, particularly over the long term. A typical FIA may charge between 1% and 1.5% in fees when income riders or bonuses are involved, but this is still far more competitive than the 2% or higher fees that can be charged by Wirehouse brokers for managing a portfolio of stocks and bonds.

5. Annuity Bonuses and Guarantees: The Added Benefits

Another feature that annuities offer that traditional bonds simply can’t is the potential for bonuses and guarantees. Many modern fixed indexed annuities provide immediate bonuses on initial investments, often ranging from 10% to 27%. These bonuses can be incredibly beneficial in jumpstarting the growth of the annuity, giving it a significant advantage over traditional bond portfolios.

For instance, some annuities offer income account value bonuses, which guarantee higher payouts in retirement, ensuring that annuity holders will have a reliable income stream that exceeds the traditional 4% annual withdrawal rate that many financial planners recommend.

6. The Safe and Smart Investment: No Market Risk

One of the most significant advantages of fixed indexed annuities over bonds is the absence of market risk. While bonds have experienced significant volatility in recent years, especially with rising interest rates, fixed indexed annuities are tied to the performance of a market index, but they do not expose the investor to market losses.

In 2008, during the global financial crisis, the S&P 500 lost 50.1% of its value. Similarly, in 2022, the market again faced steep declines. But for those who had invested in fixed indexed annuities, they lost zero dollars. That’s the kind of financial protection that bonds simply can’t offer.

7. The Real Problem: The Wirehouse Bias Against Annuities

Wirehouse stockbrokers continue to push the narrative that annuities are too costly, too complicated, and too risky. But the real problem here is that their business model is at odds with the value annuities bring to the table. The more clients move away from stock portfolios and traditional bond investments toward annuities, the less revenue Wirehouse brokers stand to make.

This bias against annuities is perpetuated by financial media outlets, many of which rely on advertising dollars from large Wirehouse firms. For example, The Wall Street Journal, CNBC, and Fox Business have all perpetuated the anti-annuity narrative, even though these products have consistently outperformed traditional bond portfolios (Advisor Perspectives, Annuity Alliance).

8. A Smarter Approach to Retirement Income

The fact is, the investment world has changed. With the current environment of rising interest rates, volatile stock markets, and inflated bond valuations, traditional investment strategies—like the 60/40 portfolio—are no longer the best way to ensure a secure retirement. Fixed indexed annuities offer a better, safer, and more cost-effective alternative for retirees who are seeking steady, predictable income without market risk.

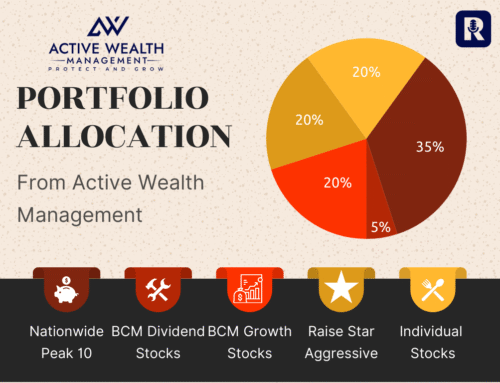

Instead of relying on traditional bond portfolios or stock-heavy investments, we recommend moving the income portion of your portfolio into fixed indexed annuities. This provides the stability and growth potential retirees need, without the ongoing advisory fees, trading commissions, or market risks that come with traditional stock and bond investments (TIAA).

Conclusion

The evidence is clear: Wirehouse stockbrokers have got it wrong regarding annuities. They continue to push outdated investment strategies that come with high fees, market risks, and poor performance—especially when compared to the benefits that fixed indexed annuities can provide.

By choosing to invest in annuities, you can:

- Avoid high advisory, portfolio, and trading fees.

- Secure market-like returns without exposure to market risk.

- Enjoy immediate bonuses and guarantees that traditional bond portfolios can’t match.

- Sleep easy knowing that your retirement income is protected, regardless of economic conditions.

As we move forward, it’s essential to recognize the real benefits of fixed indexed annuities and make informed decisions that will ensure your financial security. If you’d like to learn more about how fixed indexed annuities can work for you, I invite you to call me, Ford Stokes, at 1-888-814-0304 for a complimentary consultation. Or, email me directly at ford@activewealth.com to get started on your personalized financial plan.

References:

- Advisor Perspectives – Bonds and Inflation-Indexed Annuities: Which Is More Efficient?

- Annuity Alliance – Comparing Fixed Indexed Annuities to Bonds

- TIAA – Diversify Retirement Allocation with Guaranteed Fixed-Income Assets Like Annuities

This example is for illustrative purposes only and does not take into account your particular investment objectives, financial situation or needs and may not be suitable for all investors. It is not intended to project the performance of any specific investment and is not a solicitation or recommendation of any investment strategy.

Actual investment experience will vary with product selection and changing market conditions. Index or fixed annuities are not designed for short term investments and may be subject to caps, restrictions, fees and surrender charges as described in the annuity contract. Guarantees are backed by the financial strength and claims paying ability of the issuer.

Investment advisory services offered through Brookstone Capital Management, LLC (BCM), a registered investment advisor. BCM and Active Wealth Management are independent of each other. Insurance products and services are not offered through BCM but are offered and sold through individually licensed and appointed agents.