At Active Wealth Management, we believe that smart retirement planning and portfolio construction must be rooted in diversification, growth potential, risk management, and guaranteed income strategies. Here’s an example of how we help our clients build an optimized and well-balanced portfolio designed for long-term success in retirement.

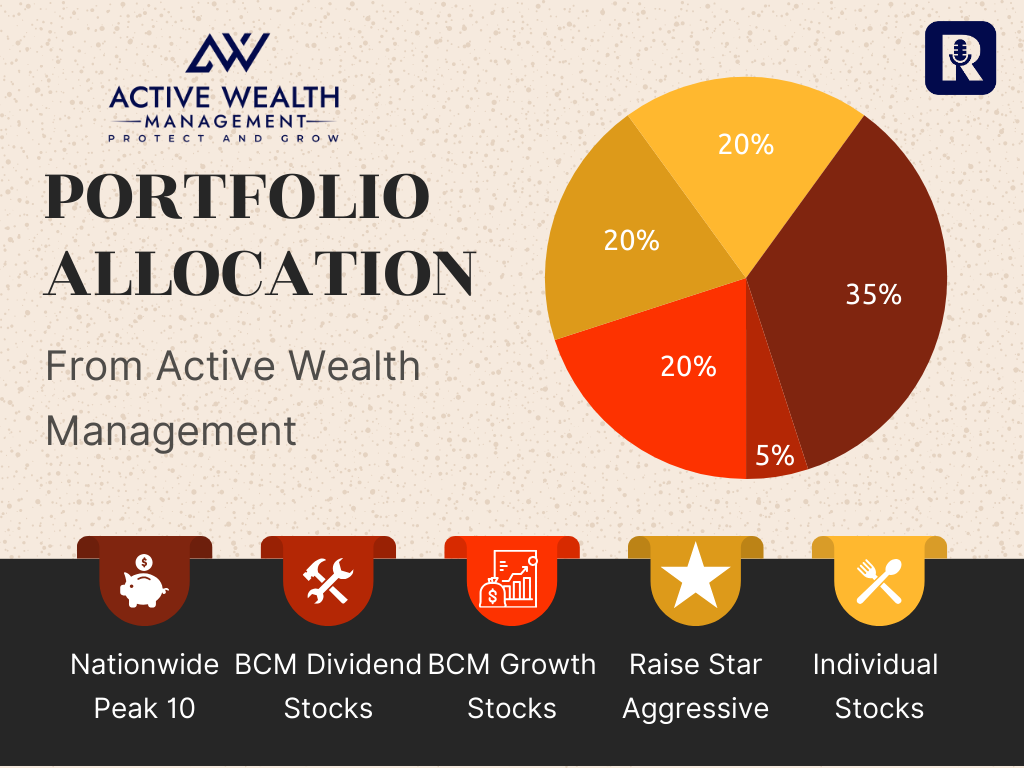

📊 Portfolio Allocation Breakdown

This example diversified portfolio includes a combination of growth stocks, dividend-paying equities, individual high-conviction picks, and a powerful annuity vehicle:

| Portfolio Component | Allocation |

| BCM Growth Basket of Stocks | 20% |

| BCM Dividend Basket of Stocks | 20% |

| Raise 360° Star Aggressive Portfolio | 20% |

| High-Potential Individual Stocks | 5% |

| Nationwide Peak 10 Fixed Indexed Annuity | 35% |

| Total | 100% |

Let’s break down each component.

🚀 20% – BCM Growth Basket of Stocks

The BCM Growth Stock Basket provides targeted exposure to high-quality, fast-growing companies. This strategy takes a bottom-up, research-driven approach, focusing on long-term capital appreciation. Key current holdings include tech leaders like Apple (AAPL), Microsoft (MSFT), NVIDIA (NVDA), Alphabet (GOOGL), and Amazon (AMZN).

- Strategy Focus: Long-term growth, strong fundamentals

- Inception Date: 10/1/2021

- Top Sectors: Tech, Consumer Discretionary, Industrials

👉 Ideal for investors seeking market upside with a curated list of strong growth names.

💰 20% – BCM Dividend Basket of Stocks

The BCM Dividend Stock Basket provides reliable income through exposure to high-quality, dividend-paying companies such as AT&T (T), Dominion Energy (D), Gilead Sciences (GILD), and Ford (F).

- Strategy Focus: Dividend income + growth potential

- Recent Dividend Yields: Ranged from 3% to over 8%

👉 Ideal for clients who want income-producing assets with potential appreciation over time.

📈 20% – RAISE 360° Star Aggressive Portfolio

The RAISE 360° Star Aggressive Portfolio is a high-growth, risk-based portfolio that blends active management with passive ETFs. It includes strong exposure to the NASDAQ-100 via QQQ (16%), plus positions in Vanguard Growth (VUG), Vanguard Value (VTV), and Emerging Markets (IEMG).

- Key Holdings: QQQ, VUG, VTV, IEMG, IEFA

- Total Equity Exposure: 98%

👉 Perfect for clients seeking global growth and efficient asset allocation using ETFs.

📌 5% – Individual High-Conviction Stocks

We reserve 5% of the portfolio for hand-picked individual stocks with strong forecasted growth over the next 12 months. These could include:

- Disruptive technology companies

- Innovative biotech, pharma and healthcare firms

- Green energy leaders

- AI-driven software companies

👉 This allocation allows for personalized positioning and tactical alpha-generation.

🛡️ 35% – Nationwide Peak 10 Fixed Indexed Annuity

The Nationwide Peak 10 Fixed Indexed Annuity is the cornerstone of this portfolio’s retirement income strategy. It combines upfront bonuses, guaranteed growth, and equity index participation with principal protection.

Key Features:

- ✅ 25% Immediate Income Benefit Bonus

- 💸 8% Guaranteed Simple Interest into the Income Benefit account each year you defer withdrawals

- 📈 310% Participation in BNP Paribas Global H-Factor Index every 2-year protection period

- 🔒 No market losses, your money is not exposed to financial market loss. 100% of your premium is invested in 10-Year US Treasury Bonds and only the interest is invested in options in the BNP Paribas Global H-Factor index. In a down year, you will not lose any of your principal invested. Your principal and gains are locked in every two years on your policy’s anniversary date.

- 📆 Ideal for clients planning to retire in 2–10 years

👉 This annuity provides both guaranteed income and opportunity for growth, helping secure financial confidence for retirement.

🎯 Why This Allocation Works

This portfolio is designed to be:

| Objective | How It’s Achieved |

| Growth-Oriented | BCM Growth Basket, RAISE Star Aggressive, Individual Picks |

| Income-Focused | BCM Dividend Basket, Nationwide Peak 10 FIA |

| Risk-Managed | FIAs offer principal protection; diversified ETFs mitigate volatility |

| Tax-Efficient | Indexed annuities grow tax-deferred; passive ETFs lower turnover |

| Longevity-Focused | Income guaranteed for life with Peak 10 FIA |

Diversifying your tax buckets is a crucial part of building a tax-efficient retirement portfolio. By spreading your assets across taxable, tax-deferred, and tax-free accounts, you gain greater flexibility in managing your income in retirement and minimizing your tax liability over time. Taxable investment accounts (like brokerage accounts) are funded with after-tax dollars, and while dividends, interest, and capital gains are subject to taxes, they also provide liquidity without early withdrawal penalties—making them ideal for short- or mid-term planning and strategic withdrawals during low-income years.

Tax-deferred accounts such as Traditional IRAs, 401(k)s, and 403(b)s allow your investments to grow without being taxed until you withdraw the funds. While these accounts often reduce your taxable income today, withdrawals in retirement are taxed as ordinary income—and after age 73 (or 75, depending on your birth year), you’re required to take minimum distributions (RMDs). Having too much of your portfolio in tax-deferred accounts can lead to a higher tax burden in retirement, which is why it’s smart to also build up other tax-advantaged buckets.

The Roth IRA and Roth 401(k) represent the tax-free bucket—funded with after-tax dollars, these accounts allow for completely tax-free withdrawals in retirement, including all gains, if certain conditions are met. Roth accounts are a powerful hedge against future tax increases, and can be strategically used to manage your taxable income in retirement, especially when combined with tax-deferred and taxable assets. A well-diversified tax strategy using all three buckets—taxable, tax-deferred, and tax-free—gives you more control, more options, and potentially less tax drag on your retirement income.

👨💼 Partner With Active Wealth Management

At Active Wealth Management, we tailor every portfolio to our clients’ risk tolerance, retirement timeline, and legacy goals. This allocation serves as a blueprint for our Smart Retirement Plan, giving clients:

- ✅ Consistent income

- ✅ Strong growth opportunities

- ✅ Downside protection

- ✅ Tax-advantaged accumulation

If you’re looking to build a fee-efficient, market-efficient, and tax-efficient retirement portfolio, let’s talk.

📞 Call 1-888-814-0304

📧 Visit RetirementResults.com

📘 Request a free copy of The Smart Retirement Plan by Ford Stokes, RSSA, MBA by emailing him at ford@activewealth.com or visiting retirementresults.com/plan