Protect your savings, grow your wealth, and secure income you can’t outlive.

The Market Has Changed — Your “Safe Money” Strategy Should Too

If you’re nearing or already in retirement, you’ve probably noticed that traditional bonds aren’t what they used to be.

Interest rates have fallen, inflation has crept up, and bond returns no longer keep pace with the cost of living.

That’s why more retirees are replacing part of their bond portfolio with Fixed Indexed Annuities (FIAs) — a modern way to protect principal, earn competitive growth, and even lock in a lifetime income stream.

How Fixed Indexed Annuities Really Work

A Fixed Indexed Annuity (FIA) is an insurance contract designed to protect your principal while linking your growth to a market index such as the S&P 500® or the BNP Paribas Global H-Factor Index.

Here’s the simplified version:

-

Your money is protected — you can’t lose principal due to market downturns.

-

The insurance company invests your premium in safe assets like U.S. Treasuries and uses the interest to purchase options tied to an index.

-

If the index goes up, your account is credited with interest based on a participation rate or cap.

-

If the index goes down, you simply earn 0% for that period — never negative returns.

-

You can typically withdraw up to 10% of your account value each year without penalty.

-

Many FIAs include lifetime income riders so you can turn your contract into a guaranteed retirement paycheck.

In short: you participate in market growth without market loss.

Why FIAs Are a Great Bond Replacement

Today’s bonds come with market risk, interest-rate risk, and reinvestment risk.

FIAs eliminate those risks while offering:

✅ Principal protection — you never lose money due to market downturns.

✅ Tax-deferred growth — no annual taxation on gains until withdrawn.

✅ No advisory or portfolio fees.

✅ Potential double-digit growth — depending on index performance and participation rates.

✅ Guaranteed income for life (optional riders).

It’s the “sleep-well-at-night” product that blends safety, growth, and income — all in one solution.

Three Fixed Indexed Annuities That Shine in 2025

1️⃣ Nationwide Peak 10 — from A+-Rated Nationwide

-

25% Immediate Bonus into the Bonus + Income account

-

8% guaranteed annual interest into that account

-

295% participation rate in the BNP Paribas Global H-Factor Index

-

Average illustrated 12.02% annual growth over the last decade of index performance

This is a powerful option for retirees seeking protected growth and reliable income from one of America’s most trusted names.

2️⃣ Aspida Synergy Max — from A–Rated Aspida

-

113% participation rate in the Invesco QQQ Index

-

Access to strong tech-driven growth without stock market risk

-

Ideal for pre-retirees looking to replace bond holdings with a more dynamic, safe-growth solution.

3️⃣ North American Charter Plus 14 — from A+-Rated North American Company

-

25% immediate account-value bonus, vesting over 10 years

-

Linked to a Market Volatility Control Index with S&P 500® participation

-

Illustrated 7.17% average annual growth rate

-

Great for long-term investors who want safety with meaningful upside.

Why Now Is the Time to Re-Think Bonds

With bond yields still low and market uncertainty rising, shifting part of your fixed-income allocation into Fixed Indexed Annuities can:

-

Reduce volatility in your portfolio

-

Eliminate market-driven bond losses

-

Generate more consistent growth

-

Guarantee an income you can never outlive

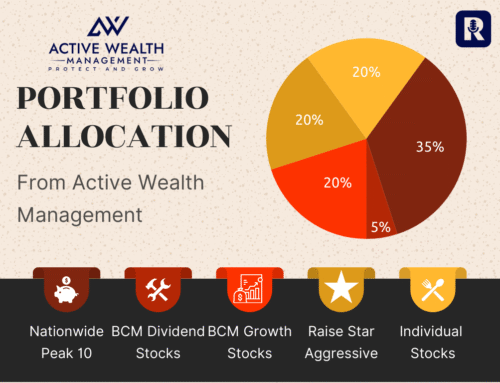

At Active Wealth Management, we believe in helping clients achieve Market-Efficient, Fee-Efficient, and Tax-Efficient retirements — and FIAs are one of our favorite ways to do that.

Ready to See How an FIA Fits in Your Plan?

Schedule your Free Fixed Indexed Annuity Illustration and Portfolio Review today.

Call 770-685-1777 or visit RetirementResults.com to request your custom illustration.

Or, book directly with Ford Stokes, RSSA®, MBA at

👉 https://calendly.com/fordstokes

Let’s protect your portfolio — and your peace of mind.

Active Wealth Management, Inc. | 1740 Grassland Parkway, Building #206, Alpharetta, GA. 30004 | Phone: (770) 685-1777

Investment advisory services offered through Brookstone Capital Management, LLC (BCM), a registered investment advisor. BCM and Active Wealth Management are independent of each other. Insurance products and services are not offered through BCM but are offered and sold through individually licensed and appointed agents.