Written by Ford Stokes, MBA, RSSA

A Smarter Approach to Preserve Capital, Lock in Growth, and Generate Income Later

As you enter your 40s and 50s, your retirement horizon is still meaningful—but the stakes are rising. You have less time to recover from major market or interest-rate shocks, your health and longevity risk become more relevant, and you may be seeking not just growth but durable income and principal preservation. In this environment, conventional bonds may no longer be serving your goals as effectively as they once did. And that’s where certain fixed indexed annuities (FIAs) step in.

The Problem with Bonds Today

For decades, pension plans and individual portfolios allocated heavily to high-quality bonds for safety and income. But several headwinds are now challenging that model:

- Interest-rate risk – When interest rates rise, bond prices fall. If you hold long-duration or intermediate bonds, you may see capital losses if rates move up.

- Fee drag and hidden costs – Many bond-based strategies increasingly involve bond funds, actively managed portfolios or advisory/portfolio fees that eat into returns.

- Limited income-for-life capability – While bonds pay coupons, they do not inherently provide a guaranteed lifetime income that cannot be outlived.

- Inflation vulnerability + low yields – With yields low and inflation pressures persistent, real returns from bonds may be modest or negative.

- Correlation to markets and rates – Though traditionally “safe,” bonds are still exposed to macro risks (rates, credit, reinvestment) that may reduce reliability during major stress periods.

In short, bonds may still have a role, but for many in their 40s/50s seeking to protect retirement capital while preparing for income later, they may not be enough.

What Are Fixed Indexed Annuities (FIAs) and How Do They Work?

A fixed indexed annuity is an insurance-company product that combines a guarantee of principal (i.e., you won’t lose your deposit due to market losses) with the potential for upside based on the performance of a market index. (nationwide.com)

Here are the key mechanics and features to understand:

Mechanics

- You put premium into the FIA (single or multiple payments).

- The contract credits interest (or increases account value) based on the performance of one or more indices (for example, the S&P 500®, Nasdaq 100, or other index) but you are not directly invested in the index. (thrivent.com)

- If the index goes up, you participate via a “participation rate,” or after a “spread,” or up to a “cap,” depending on the contract terms. (Investopedia)

- If the index goes down (or underperforms), you typically do not lose your principal or credited gains — the loss is essentially the opportunity cost of not participating more fully in the upside. (athene.com)

- The contract may allow you to defer withdrawals (accumulation phase) and then later start taking lifetime income payments (income phase) or lock in gains, or both. (Schwab Brokerage)

How FIAs fit as a hybrid instrument

Think of an FIA as a hybrid between conservative fixed instruments (like high-grade bonds or fixed annuities) and growth-oriented investments (like equities). It gives you:

- The protection of principal (more like a bond or fixed annuity).

- The upside potential tied to market indexes (like equities) — but without direct downside market risk.

- Usually tax-deferred growth until you start withdrawals. (nationwide.com)

- Possibly an option to convert to a lifetime income stream — which bonds do not inherently offer.

Because of these features, FIAs can serve as a growth-with-protection component in a retirement portfolio, especially for those who are approaching the income-phase horizon and want to reduce risk.

Regulation & Safety

- FIAs are not federally regulated as securities (like variable annuities) but rather as insurance products, primarily regulated by each state’s insurance department. (Annuity.org)

- The guarantees (principal and credited-gain protection) are backed by the issuing insurance company’s financial strength and the reserve/solvency regulation in each state. Many states require insurance companies to maintain reserves that at minimum equal contract obligations. (Annuity.com)

- The National Association of Insurance Commissioners (NAIC) tracks model laws and guides states in their regulation of annuities. (content.naic.org)

Important: While FIAs can reduce downside risk, they still carry complexity (participation rates, spreads, surrender charges, liquidity constraints) and their performance depends heavily on contract terms and the financial strength of the insurer. (Bankrate)

Why Workers in Their 40s/50s Should Consider Replacing Some Bonds with FIAs

Here are the key strategic reasons this shift makes sense for the 40-50s cohort:

- Lock in principal and gains – Unlike bonds subject to interest-rate price declines, many FIAs lock in increases at defined reset intervals. If you select a product that “locks” gains every two years, you convert market upside into a protected asset.

- Eliminate interest-rate risk – FIAs aren’t directly exposed to rising interest-rate losses the way bonds are (though they do face insurer credit risk). This can be especially relevant when rates are low but expected to move higher.

- Avoid ongoing portfolio/management fees – Many bond portfolios, especially diversified or managed ones, include advisory and portfolio fees. A well-structured FIA may eliminate advisory/portfolio management fees — the contract is what it is.

- Capture market-linked growth while preserving safety – FIAs provide a way to participate, partially, in market upside, but with protection of principal. For someone in their 40s/50s, that gives more growth potential than passive bonds, with less downside than full equity exposure.

- Create a foundation for later-life income – Many FIAs include lifetime-income riders or deferred income options, which can convert your accumulation into a dependable paycheck in retirement. Bonds do not inherently do this.

- Time horizon matters – If you defer income for 10+ years (as many FIAs allow) you benefit from compounding and from locking gains over the accumulation period, which is ideal for someone in their 40s/50s who is still 10-15 years from full retirement.

- Portfolio diversification and safety-first posture – As you near retirement or transition to income mode, shifting some risk out of bonds (especially long-duration bonds) into FIAs can be a prudent hedge while still maintaining growth potential.

Two Specific FIA Offerings Worth Considering

Here are two fixed indexed annuity offerings that align with the above strategy — each designed to replace a portion of a bond allocation with an annuity-based alternative that gives you growth potential, principal protection, and long-term income readiness.

- Nationwide Peak 10 (NWP10)

- Immediate bonus: 25% added into the income benefit account upon purchase.

- Deferred interest: 8% guaranteed interest each year you defer withdrawals.

- Indexed growth: 295% participation rate in the performance of the BNP Paribas Global H‑Factor Index. Example: If the index goes up 5% for two consecutive years, you would receive credited growth of 29.5% (i.e., 5% × 2 years × 2.95) less the 1% spread = net ~28.5%.

- Fee structure: 1% annual fee plus a 1% crediting spread rate when you have gains.

- Lock-in: Principal and gains are locked every two years.

- Aspida Synergy Choice Max

- Index: tied to the performance of the Invesco QQQ (Nasdaq-100 ETF) with a participation rate of 113%. Example: If QQQ goes up 30% over the two-year protection period, your account grows by 33.9% (30% × 1.13).

- Fee structure: No annual advisory or portfolio fees. The company makes money off the money you invest; you do not have an annual 1% fee/crediting spread.

- Lock-in: Principal and gains locked every two years on the product anniversary date.

These two products are illustrative of how an FIA can deliver: growth tied to market indexes, protection of principal, deferred income potential, and a defined fee structure — offering a compelling alternative to bond allocations for suitable clients.

Bond vs Fixed Indexed Annuity: A Comparison

Here’s a high-level graphic comparison of key attributes:

| Feature | Bonds | Fixed Indexed Annuities (FIAs) |

| Interest-rate risk | Yes — price falls when rates rise | No direct interest-rate price risk (principal generally protected) |

| Market downside risk | Some (credit risk, duration risk) | Limited — downside market losses are typically absorbed by insurer |

| Management/advisory fees | Often present in funds/portfolios | Often none (depending on contract) |

| Growth potential tied to market | Limited — coupon + yield | Participation in index upside (via participation/spread/cap) |

| Principal protection | Not guaranteed — bond values fluctuate | Yes (guaranteed by insurer, subject to terms) |

| Lifetime income option | Not inherent | Yes — many FIAs provide lifetime-income riders |

| Suitable for long-term deferral | Yes | Yes — especially attractive when deferring for 10+ years |

| Liquidity / surrender risk | Bonds are liquid (depending on type) | FIAs often have surrender charges if early withdrawal |

In short, FIAs offer a combination of growth potential and guarantee that bonds simply do not. For those in their 40s and 50s, this is a powerful strategic edge.

Why Now Is the Time

- With interest rates elevated, bonds face valuation risk and reinvestment risk.

- The 40s/50s demographic still has time to defer income for 10+ years, which aligns perfectly with FIA features (bonus stacking, income-benefit accumulation, market-index based growth).

- As retirement nears, shifting some allocation out of less productive bonds into growth-with-protection vehicles helps reposition for income phase while managing risks.

- Low-cost alternatives and transparent fee structures in FIAs mean you’re not paying for portfolio overlays or active bond management.

Important Considerations & Suitability

- Liquidity and surrender charges – FIAs are long-term vehicles. Early withdrawals may incur penalties or reduce benefits.

- Crediting method details matter – participation rates, spreads, caps, reset periods, indexing methodology all vary by contract. (United States of America)

- Insurance-company strength matters – Guarantees are only as reliable as the issuing insurer. Check ratings and state regulation/reserve compliance.

- Not a wholesale replacement for equities – FIAs provide limited upside compared to full equity exposure; they’re best used as a strategic portion of the portfolio.

- Tax treatment – Growth is tax-deferred; withdrawals are taxed as ordinary income; early withdrawals (before age 59½) may incur penalties.

- State regulation varies – Each U.S. state regulates annuities via its insurance department, and reserve/solvency frameworks vary by state. (soa.org)

- Product complexity – You should understand the contract in full, the fees, the surrender schedule, the reset and locking-in features. Consultation with a qualified advisor is prudent.

Putting It Into Your Portfolio

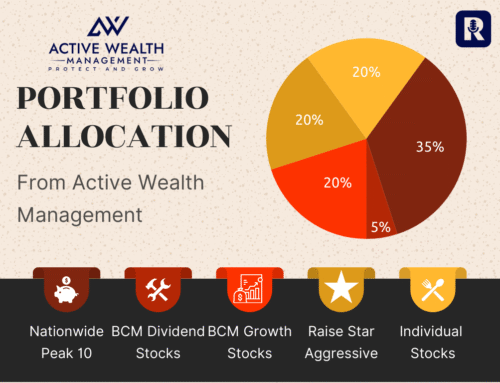

For a worker age 45-55, here’s a possible strategic approach:

- Keep a core of conservative fixed-income but reduce long-duration bond exposures that carry interest-rate risk.

- Allocate a portion of the replaced bond assets (for example 10-20 % of portfolio) to FIAs — e.g., the two above — with a 10-15-year deferral horizon, locking in growth gains and setting up income later.

- Continue growth allocations (equities, real assets, etc.) but balance them with growth-with-protection instruments (FIAs) so you reduce overall portfolio risk while still retaining upside.

- Monitor periodically, ensure the insurance company remains strong, and align the FIA’s income-start age with your retirement planning horizon.

Summary

For workers in their 40s and 50s who are increasingly focused on capital preservation, income generation, and protection from market/interest-rate shocks, replacing a portion of their bond allocation with one or more well-chosen fixed indexed annuities can be a powerful strategy. By locking in principal, capturing meaningful market upside, deferring income for 10+ years, and eliminating typical bond-portfolio risks, FIAs can serve as a valuable bridge to the income phase of retirement.

If you examine the specific products mentioned above — Nationwide Peak 10 and Aspida Synergy Choice Max — you’ll see how they bring bonus stacking, participation rates, principal lock-in and no/low fees together. When properly understood and aligned with your financial goals and risk tolerance, they may offer a superior alternative to simply sticking with bonds in an uncertain rate and market environment.

About Ford Stokes

Ford Stokes is the author of The Smart Retirement Plan and serves as the Founder, President and Chief Financial Advisor with Active Wealth Management. Ford Stokes is also the host of the financial radio show and podcast,Retirement Results. He holds an MBA, is a licensed financial advisor and insurance agent. Ford is also a Registered Social Security Analyst (RSSA). Ford works with workers and retirees to deploy truly diversified retirement portfolios that reduce risk, increase longevity protection, and position clients for a lifetime of financial freedom.

Contact Information:

- Phone: 770-685-177

- Email: ford@activewealth.com

- Websites: RetirementResults.com / ActiveWealth.com]

- Offices:

- Alpharetta: 1740 Grassland Pkwy, Bldg #206, Alpharetta, GA 30004

- Midtown Atlanta: 1175 Peachtree St NE, Suite 1000, Atlanta, GA 30361

If you’re in your 40s or 50s and would like a targeted strategy to move beyond traditional bonds and toward a retirement-income portfolio built for the long run, contact Ford today at 770-685-1777 or send him an email at ford@activewealth.com. .