The Coronavirus pandemic has wreaked havoc on many people’s finances. While it’s always important to know where you stand financially, it is more important than ever to assess where you stand after the pandemic and think about how you can improve your financial position. We’ve compiled a list of 7 questions you can ask yourself when assessing your financial health.

What’s my net worth?

This is a common way to see where you stand quickly. To calculate your net worth, you simply take the value of your assets and subtract your liabilities.

- Write down everything you own that is considered an asset (i.e., cash, investments, your home)

- Subtract everything you have as a debt (i.e., student loans, credit card debt, mortgage)

- Your income does NOT factor into this calculation

You should use your net worth as a way to compare to yourself. For example, as you pay down your mortgage, your net worth will increase. It’s okay if you have a negative net worth right now! You should use your net worth as marker and keep track of it regularly. A good idea is to focus on increasing your net worth 5-10 percent each year as you pay down your debts and accumulate more assets.

What’s my debt-to-income ratio?

Your debt-to-income ratio is calculated by taking the total amount you pay in debt payments and dividing it by your monthly gross income. Most people recommend a debt-to-income ratio of 30 percent or lower. Why is this number important? It will help you know whether your debt is under control and it is also a primary factor in your credit score and acquiring new credit.

What’s my housing situation?

In 2017, Americans spent almost 40 percent of their budget on housing. We are continuously getting into homes that we can’t afford. If we want to avoid another housing crisis, Americans need to evaluate their current housing situations and get themselves into housing they can afford. There are other variables that play into your housing situation besides rent, such as gas and parking for your commute to work. Depending on where you live, these values can fluctuate. Having a roommate is a good way to offset your housing costs, especially in a large city. One way to evaluate your housing situation is to think about how much space you need. Don’t pay for more space than you’ll use!

Where is my money going?

If you’re not budgeting, you should be. If you haven’t redone your budget in a while, now is the time to sit down and reevaluate it. Budgeting helps you be aware of where your money is going every month and keeps you in the know on your spending habits. Understanding where you spend most of your money can help you know areas where you might need to cut back. Knowing where your money is going is a great way to get ahead financially.

If you need help getting started, a budgeting app might be a good idea. Check out this list on Nerdwallet of the some good options: https://www.nerdwallet.com/blog/finance/budgeting-saving-tools/.

Am I saving for retirement?

You should be evaluating whether you’re meeting your retirement goals annually. If you don’t have any goals for saving for retirement, you should create some. A good place to start is to make sure you are contributing the maximum allowed to your retirement accounts. Talk with a financial planner you trust if you are unsure where to begin when it comes to retirement. It’s never too early to start saving. The more you save, the more comfortably you will live when you’re older.

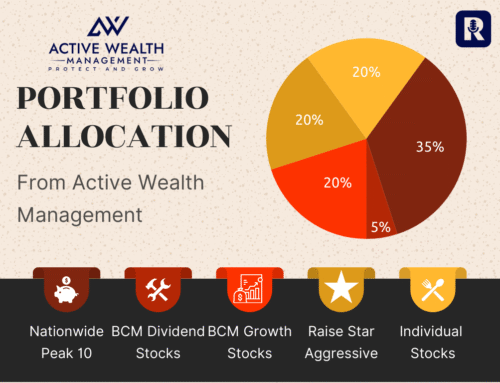

What’s my investment strategy?

If you aren’t investing, you should be! Saving is important, but investing is the best way to grow your money for the future. There are a couple factors you need to think about when choosing an investment strategy:

- Your risk tolerance: This will help you decide how much you want to put in stocks and other investments in the market.

- Your values and goals: Knowing your values and goals will help you know the kinds of companies you want to invest in.

What are my financial goals?

Establishing clear financial goals is the first and most important thing you should do when assessing your financial health. Without an idea of where you want to go, how can you know what to look for and what to plan? You can never get to where you want to be if you don’t know where that place is. Establish both short-term and long-term financial goals and write them down!

If you are concerned about any of the topics covered in this blog, don’t hesitate to reach out! Give us a call at (770) 685-1777 or visit activewealth.com/consult to schedule your FREE consultation. We can help you assess your financial health and create goals to make this process easier for you in the future. Don’t neglect your financial health – this is key to many other aspects of your life.

Investment advisory services offered through Brookstone Capital Management LLC (BCM), a registered investment advisor. BCM and Active Wealth Management are independent of each other. Insurance products and services are not offered through BCM, but are offered and sold through individually licensed and appointed agents. Investments involve risk and, unless otherwise stated, are not guaranteed. Past performance cannot be used as an indicator to determine future results.

***

Active Wealth Management is a private wealth management firm located in Atlanta, GA. Our team is passionate about educating clients in order to empower them to invest and retire successfully and we believe in managing our client’s assets actively. Active Wealth Management works with three primary groups of people; pre-retirees, retirees, and business owners.

Active Wealth Management is led by our Founder and President, Ford Stokes, and by our Senior Vice President, Brandy Seats. They aim to help clients understand their current financial situation, analyze their current portfolio, and develop a customized financial plan to accomplish their goals. If you would like more information about the firm, please visit our website, https://activewealth.com, or call our office at (770) 685-1777. You will not be passed off to another advisor. You will meet with either Ford or Brandy. You can schedule directly into their calendars at https://activewealth.com/consult/.