getty

As a significant milestone in one’s life, retirement can quickly become a financial burden without proper planning. As a pre-retiree and a professional in the financial services industry, I see the importance of retirement planning daily. The following are several tips to help you ensure your financial future is bright.

Review Your Overall Retirement Plan To Make Sure You Are On Track

Reviewing your overall retirement plan periodically ensures you remain on track to meet your goals. Your financial situation and retirement goals may change as you age, so ensuring your plan still aligns with your current needs and objectives is important.

For example, a prospect called me recently after listening to my podcast, Retirement Results, saying that his company was offering him a significant six-month severance package to retire three years earlier than he was expecting to retire and wanting my help to evaluate his situation. His financial plan changed, and he had to factor in a lower overall salary. He also wanted to factor in starting his Roth ladder conversion plan two to three years earlier than he had planned. He and his wife reduced their expenses and lifestyle and implemented a retirement income plan to enable him to retire earlier.

Here are a few key steps when reviewing your retirement plan:

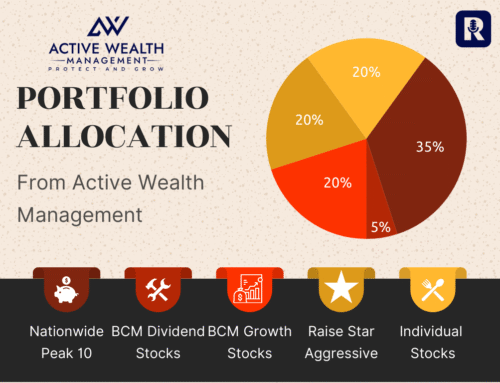

• Review your asset allocation. This is the mix of investments in your retirement portfolio, such as stocks, bonds and cash. As you get closer to retirement, you may want to gradually shift your asset allocation to a more conservative mix to reduce risk.

• Rebalance your portfolio, if needed. Rebalancing means adjusting your asset allocation to your target mix when it gets out of balance due to market fluctuations. This will help you maintain your risk tolerance level and stay on track with your retirement goals.

• Make sure your retirement savings are on track. Use a retirement calculator to estimate how much you need to save each month to reach your retirement savings goal. You may need to adjust your savings plan if you are behind.

Develop A Retirement Income Plan You Can Count On

Developing a realistic retirement income plan is crucial for providing financial stability during your golden years. With increasing life expectancy, you could spend nearly as much time in retirement as you did working. A fundamental aspect of retirement planning is creating and sticking to a budget. List your income and expenses, including your fixed and variable costs, and make sure you include everything. This will give you an idea of where to cut costs and make adjustments to free up more discretionary funds to use for your retirement savings. Don’t forget to plan for emergencies and unexpected costs.

Once you’ve made any necessary adjustments, you can increase contributions to your retirement savings funds and explore the various retirement investment vehicles that best fit your needs and goals.

Consider A Roth Ladder Conversion

This strategy involves converting some of your traditional IRA savings into a Roth IRA. With a traditional IRA, you get a tax deduction for your contributions, but you pay taxes on your retirement withdrawal. With a Roth IRA, you pay taxes on your contributions now, but your retirement withdrawal is tax-free. So this could be a smart move if you expect your tax bracket will be higher in retirement.

There are a few things to consider before doing a Roth ladder conversion. First, you must ensure you have enough money to cover the taxes on your converted funds. Second, you must decide how much of your traditional IRA you want to convert. And third, you need to be aware of the five-year rule, which states that you can’t withdraw money from your Roth IRA for five years after you convert it. If you withdraw money before the five-year mark, you’ll pay taxes on your withdrawals plus a 10% penalty.

Staying On Track

By periodically reviewing your overall retirement plan and adjusting where necessary, you can help ensure you are on track to achieve your retirement goals. Consider working with a financial advisor who can help you tailor your plan to your goals.

Taking the time to make sure your plan still aligns with your needs and objectives can help you retire with confidence and financial security.

The information provided here is not investment, tax, or financial advice. You should consult with a licensed professional for advice concerning your specific situation.

Ford Stokes is the President of Active Wealth Mgmt and Host of The Active Wealth Show.