Written By: Ford Stokes, RSSA, MBA

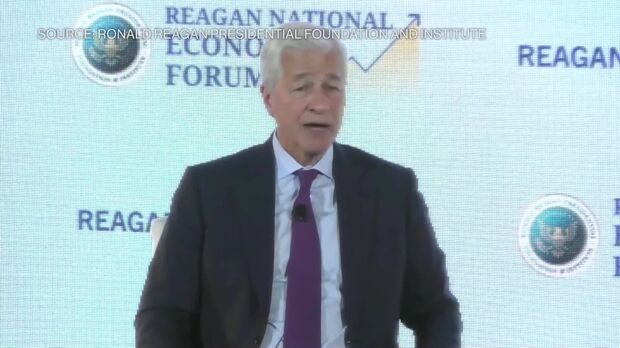

“You are going to see a crack in the bond market. It is going to happen.”

These are the chilling words from Jamie Dimon, Chairman and CEO of JPMorgan Chase, as he spoke recently at the Reagan National Economic Forum. And when one of the most influential voices in global finance sends up a red flag about U.S. corporate bonds, smart investors, especially pre-retirees and retirees need to take notice.

With U.S. corporate bonds currently trading at a go-forward price-to-earnings (P/E) ratio of 135 to 1, it signals a massive overvaluation. This ratio, usually used for equities, reveals how bloated and risky the bond market has become. When bonds are this expensive and yields remain historically low, retirees relying on these instruments for safe income may be in for a rude awakening.

So what should you do if you have 40% or more of your retirement portfolio in bonds? The answer may lie in an increasingly popular solution among savvy retirees: Fixed Indexed Annuities (FIAs).

Why Fixed Indexed Annuities Are a Smart Bond Replacement

FIAs provide the potential for market-like growth with none of the downside market risk. Unlike bonds, which can lose value when interest rates rise or companies default, FIAs offer principal protection, guaranteed income, and growth linked to market indexes—without the volatility.

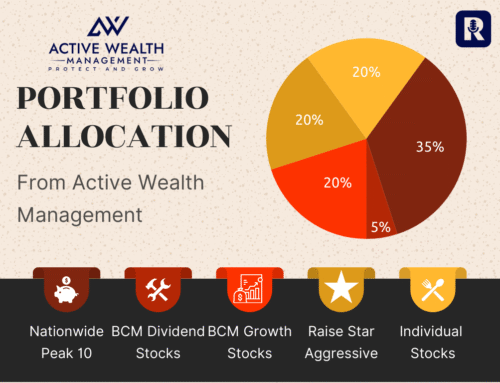

By reallocating a portion of your portfolio say 30-40% into the right mix of FIAs, you can:

- Eliminate bond market risk

- Generate consistent income for life

- Receive upfront bonuses to jumpstart your retirement income

- Avoid fees and hidden charges common with mutual funds and traditional bond products

Let’s explore two industry-leading fixed indexed annuities you should consider right now.

- Nationwide Peak 10 Fixed Indexed Annuity

Only about 1% of financial advisors in the country have access to the Nationwide Peak 10—and there’s a reason it’s considered one of the most elite annuity products available today.

Here’s what makes it stand out:

🔹 20% Immediate Bonus Into the Income Account

The moment your policy is issued, you receive a 20% income account value bonus. This bonus accelerates the growth of your future income—even before your money has a chance to earn interest.

🔹 8% Guaranteed Simple Interest Growth

Nationwide Peak 10 delivers 8% guaranteed simple interest growth annually to your income account for each year you defer taking income. This is a powerful tool for building future income and combatting inflation.

🔹 310% Participation Rate in BNP Paribas Global H-Factor Index

You’re not just getting basic interest crediting here—you get 310% participation in the BNP Paribas Global H-Factor Index, an index designed to capture high-quality, low-volatility global equities. And your gains are locked in every two-year protection period.

🔹 A+ Rated Financial Strength

Nationwide is an A+ rated annuity and insurance carrier, backed by AM Best and Standard & Poor’s. That’s the kind of security you want behind your retirement income.

➤ Summary of Benefits:

- 20% income account bonus

- 8% guaranteed income account growth

- 310% participation in BNP index

- No exposure to market losses

- 1% annual bonus + income rider fee with a 1% spread rate

- Trusted, A+ rated carrier

- Aspida Synergy Choice Bonus 10 Fixed Indexed Annuity

If you’re looking for a flexible, no-fee annuity that mirrors the growth of high-performing tech stocks with zero downside risk, then the Aspida Synergy Choice Bonus 10 may be perfect for you.

🔹 15% Immediate Account Value Bonus

Aspida delivers a 15% bonus to your account value right out of the gate, which vests over 10 years. This is an incredible way to instantly grow your retirement assets without market risk.

🔹 75% Participation in the Invesco QQQ Index

With 75% of the performance of the Invesco QQQ index (which tracks top-tier tech and growth stocks), you get the upside potential of the market without the downside exposure.

🔹 Zero Advisory, Income Rider, or Portfolio Fees

What you see is what you get. There are no hidden fees, and the product allows for up to 10% annual withdrawals without surrender charges.

🔹 Flexible and Accessible

There is no age limit to purchase the Aspida Synergy Choice Bonus 10. Young professionals and retirees alike are using it as a bond replacement strategy to secure long-term growth.

➤ Summary of Benefits:

- 15% bonus vesting over 10 years

- 75% participation in Invesco QQQ index

- No fees, riders, or market risk

- Locked-in growth every 2 years

- A- rated by AM Best and S&P

Why Replacing Bonds Makes Sense Now

We are living in an era of high inflation, rising interest rates, and economic volatility. Bonds, once the go-to for safe retirement income, are now more vulnerable than ever. Jamie Dimon’s warning is not just speculation—it’s a reflection of deep systemic stress in the fixed-income market.

Here’s what we see happening:

- Rising rates = declining bond values

- Overvalued bond market (135:1 Forward P/E ratio)

- Default risk from weaker corporate earnings

- Limited income relative to inflation

FIAs allow you to pivot to guaranteed income, market-linked growth, and peace of mind.

What You’ll Get With a Free Consultation at Active Wealth Management

When you schedule your free, no-obligation consultation with us, you’ll receive a comprehensive retirement strategy session valued at $2,500, including:

✅ 1. Free Portfolio Analysis

We’ll analyze your current portfolio and show you where you may be taking unnecessary risk—especially with bonds.

✅ 2. RSSA Roadmap

As a Registered Social Security Analyst (RSSA), Ford Stokes will personally help you maximize your Social Security income based on your work history, filing strategy, and eligibility.

✅ 3. Retirement Income Gap Analysis

We’ll identify your future income needs and compare them with your projected income sources. We’ll help you build a gap-free income plan.

✅ 4. Financial Plan to Your 95th Birthday (Existing Portfolio)

See how your current plan holds up when stress-tested for longevity, market volatility, inflation, and taxes.

✅ 5. Financial Plan to Your 95th Birthday (With Our Strategy)

We’ll also present a full plan using our recommended portfolio including FIAs, Roth ladder conversions, and tax-efficient withdrawals to delete the IRS from your retirement accounts over time.

Get Started Today

Don’t wait until the bond market cracks. Be proactive.

✅ Visit RetirementResults.com to listen to our latest radio show and podcast episodes.

✅ Claim your free copy of Ford Stokes’ new ebook, The Smart Retirement Plan, at retirementresults.com/plan

✅ Book your free consultation now by calling us at 1-888-814-0304.

You’ve worked hard to build your wealth, now it’s time to protect it and grow it wisely.

With Active Wealth Management, you can retire with confidence.

Disclosures:

Fixed Indexed Annuities are insurance products and are not securities. Guarantees are backed by the financial strength and claims-paying ability of the issuing insurance carrier. This is not a solicitation of any specific annuity. Past performance is not indicative of future results. Always consult with a licensed fiduciary advisor before making changes to your retirement strategy.

Active Wealth Management

Protect. Grow. Retire.