From making a budget to taking advantage of tax breaks and insurance, here’s a guide for new parents to help make the most of your family budget.

As a new parent, it’s normal to feel both overjoyed and overwhelmed. Fortunately, with a game plan in place, money matters are manageable — and you’ll feel much more in control. Here are 4 financial planning steps new parents can take to maximize their money and have financial security.

Step 1: Make a Family Budget

Let’s face it: It’s rarely easy for anyone to stick to a budget, since we’re all focused on getting through today. But think about what you’d like your life to look like — whether that includes a bigger home, freedom from debt, paying for you children’s college or family vacations. Sticking to a family budget is easier with a goal in mind.

Figure out your monthly income, and your fixed monthly expenses. A good plan for most is a 50/30/20 budget: 50 percent of your income goes to housing, set bills and food; 30 percent for extras (entertainment, hobbies, gifts, vacations, clothes); and 20 percent goes to savings. Be realistic about the food total: It’s rare that a mom of young kids doesn’t rely, to some extent, on takeout or prepared foods, which usually have an added cost.

As a new parent, you’ll most likely make adjustments to this budget, and that’s okay! Simply having a budget will help you when you’re starting out.

Step 2: Prepare immediately for your children’s future expenses

Let the power of compound interest start working for you. The value of a dollar invested today earning compound interest over 10, 15, or 18 years is much more valuable than a dollar invested 18 years from now.

New parents can utilize a financial advisor to help them navigate the best way to save for their children and themselves and to protect the family should something happen. These kinds of favorable tax investments are called Indexed Universal Life, which utilize life insurance as an investment strategy. It is very different than Term Life insurance which is kind of like renting – paying money, but owning nothing.

Your financial professional can also help you identify other ways to access funds if you need them. For example, The SECURE Act allows Americans who just had a baby or adopted a child to take a withdrawal of up to $5,000 from their retirement accounts, including a 401(k) or IRA, without the typical 10% penalty.

Health insurance

Uncovered medical expenses will put your financial security progress on hold (and can even send you into bankruptcy) faster than anything else. If you are new parent who does not have health insurance already, getting it for you and your child is imperative. A health sharing plan is a great option for healthy families as well, many times at a fraction of the cost of traditional health insurance.

If your employer offers coverage, get signed up now. If not, comparison-shop for policies at your state’s online Affordable Care Act Marketplace or at HealthCare.gov. While pregnancy is not a “qualifying event,” the birth of a child is — which will allow you to join your employer’s plan or the marketplace even if you opted out in the past. This is a great thing for new parents to take advantage of. You can also find a reliable broker to do the legwork for you. For more information on brokers, visit http://nahu.org.

Life insurance

While no one likes to think about the worst-case scenario, life insurance is important to ensure your kids are financially taken care of if you aren’t there. The insurance that your employer provides is likely not sufficient. Start the process by figuring out how much you need. A financial advisor can help you with this. The traditional rule of thumb is to buy 10 times your annual income in life insurance. While that may sound like an awful lot, remember that the point is to replace your lost income for years to come — at least to see your child through high school, if not college.

When it comes to life insurance, you have 3 options: Term, Universal and Whole Life. We recommend Universal because it covers several areas of need. It is not the cheapest option, like Term, but also not the most expensive, like Whole Life. The younger and healthier you are the cheaper the insurance is so this is not something to procrastinate about. Both parents should have life insurance coverage, no matter what.

Step 3: Don’t forget estate planning

Don’t let the term fool you: You don’t need to have a mansion full of valuables to need estate planning. Essentially, it means making sure your wishes are carried out after you’re gone. And everyone needs to do that, especially new parents.

If you didn’t have a will before, get one now. If you do already have a will, revise it with an attorney to designate guardians (ideally, the same age or a little younger than you) for your children. While you’re at the attorney’s office, pick an executor (the person who will put it into action) — someone you trust who’s savvy with money and organized. While you’re at it, update beneficiary designations on retirement or any other accounts you have.

Step 4: Start saving

You have to pay yourself first as you are your most valuable asset. You can not take care of others if you are not taken care of. Prioritize savings!

Start with an emergency fund. Expensive problems you can’t plan for happen all the time (like squeaky brakes or a broken refrigerator) and can crash your budget before you get started. Next, you’ll want to cover your 401(K)’s IRAs and other investments. If you don’t have any, it’s okay to just be getting started now. Any old 401(K)s should be moved into your IRA to reduce exposure to risk, fees, and to gain back control of your own investments. You do not have to be invested in the market if you are uncomfortable with the risk.

There are several ways to maintain and contribute to your IRA while protecting the principal. Working with a financial professional can help you gain all of the knowledge needed about investing for your own retirement. Once you’re covered working up a plan for your children and their future is also important. This will also protect you financially down the road from having to shell out huge sums of cash to cover their expenses.

***

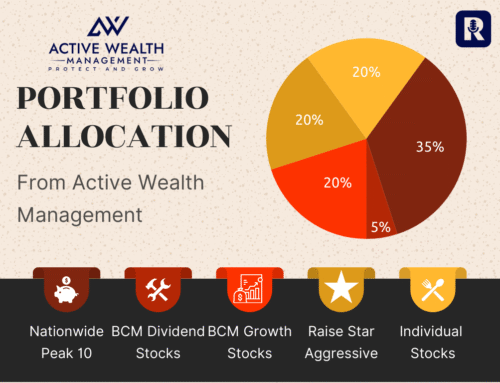

Active Wealth Management is a private wealth management firm located in Atlanta, GA. Our team is passionate about educating clients in order to empower them to invest and retire successfully and we believe in managing our client’s assets actively. Active Wealth Management works with three primary groups of people; pre-retirees, retirees, and business owners.

Active Wealth Management is led by our Founder and President, Ford Stokes, and by our Senior Vice President, Brandy Seats. They aim to help clients understand their current financial situation, analyze their current portfolio, and develop a customized financial plan to accomplish their goals. If you would like more information about the firm, please visit our website, https://activewealth.com, or call our office at (770) 685-1777. You will not be passed off to another advisor. You will meet with either Ford or Brandy. You can schedule directly into their calendars at https://activewealth.com/consult/.