Ford Stokes is the President of Active Wealth Mgmt and Host of The Active Wealth Show.

Getty

Retirees face unprecedented economic volatility, making it more critical to consider tax-free investment options for their retirement savings. The good news is they have choices that offer protection from inflation and market downturns, including permanent life insurance products and more traditional vehicles such as Roth IRAs.

Permanent Life Insurance

When it comes to tax-free retirement options, retirees can use permanent life insurance policies. Three types are available: whole life, universal life and variable life. Each brings different advantages and disadvantages regarding death benefits and cash value accumulation.

Variable life combines an investment component with a death benefit component; you invest in stocks, bonds, mutual funds, etc., which accumulate cash value at varying rates depending on their performance in the market. This means potentially higher returns but more significant risk if investments do not perform well.

Universal life offers more flexibility with adjustable premiums and death benefits; you can adjust your policy’s cash value based on current economic conditions and scale back or suspend contributions to reduce risk exposure if necessary.

Investors can shield themselves from additional Medicare surcharges, additional taxation on their Social Security income, inflation and market downturns by converting existing cash-value insurance into index-linked universal life (IUL) policies. This allows them to keep their existing investments while accessing tax-free savings during economic volatility (see IRC code 7702).

Cash value policies generally have higher fees than index-linked policies, which can reduce the money you get when you surrender or exchange them for another type of policy. Additionally, cash value policies tend to offer lower death benefits than index-linked policies because they are tied to investment performance rather than a fixed rate.

Like any financial product, IUL policies have risks and downsides, making it critical to conduct due diligence and research to find the option to fit your situation. IUL policies often have caps and participation rates that limit the growth the policy can earn. Caps set a maximum limit on the interest credited to the cash value, while participation rates determine the percentage of the index’s growth credited to the policy. These limitations can reduce potential returns.

It’s important to carefully review a policy’s terms and conditions and consider its potential risks. Working with a certified financial professional (or fiduciary) is critical.

Roth IRA

Roth IRAs can be another good option for retirees, as they offer the potential for tax-free growth and withdrawals. With Roth IRAs, retirees can further invest in their retirement and diversify their investments across various asset classes.

Unlike traditional IRAs, taxed at withdrawal time, Roth IRA contributions are made with after-tax dollars. This means that when it comes time to withdraw funds from a Roth IRA during retirement, the money is tax-free. This allows retirees to avoid paying taxes on their income while taking advantage of the benefits of retirement savings accounts.

Another benefit of Roth IRAs is that contributions can be withdrawn at any time without penalty or taxation—if certain conditions are met. For instance, if an individual has held their Roth account for more than five years and meets other criteria such as being over 59 ½ years old or withdrawing funds due to disability or death, they may be able to exit funds without penalty or taxation. This provides an extra layer of security for individuals who want access to their savings during economic volatility but don’t want to incur additional taxes or penalties on their income.

When compared to other investment options such as mutual funds and stocks, contributions made to a Roth IRA will never be subject to capital gains tax upon withdrawal—which makes them attractive for those looking for long-term investments that will help them feel more secure during economic volatility while also providing tax advantages upon withdrawal.

It’s important to note, however, that if you convert a traditional IRA to a Roth IRA during retirement, you will be subject to taxation on that conversion amount.

A Sense Of Security In Uncertain Times

Tax-free retirement options—such as Roth IRAs and permanent life insurance policies—offer retirees numerous advantages during economic volatility. Not only do they protect assets from market downturns and inflation, they can also provide retirees with a sense of security in their financial future while potentially taking advantage of tax benefits in retirement.

By researching expected returns, understanding taxation rules on withdrawals and making informed decisions about which investment option best suits them, retirees can ensure they have the best possible plan for their financial future during uncertain times.

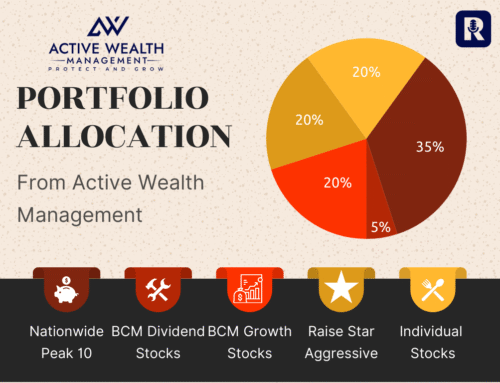

Investment advisory services are offered through Brookstone Capital Management, LLC (BCM), a registered investment advisor. BCM and Active Wealth Management are independent of each other. Insurance products and services are not offered through BCM but are offered and sold through individually licensed and appointed agents.

Ford Stokes is the President of Active Wealth Mgmt and Host of The Active Wealth Show.