If you’re nearing retirement (or already there), you don’t just need growth—you need reliable income, lower volatility, and a plan that holds up when markets don’t. The classic “60/40” portfolio—60% stocks and 40% bonds—was built for a different era. It’s 73 years old, born from Harry Markowitz’s Modern Portfolio Theory (MPT) in the early 1950s, when bonds reliably cushioned stock selloffs. MPT is still foundational, but markets, interest rates, and retirement risks have evolved. It’s time your allocation evolves too. (NobelPrize.org)

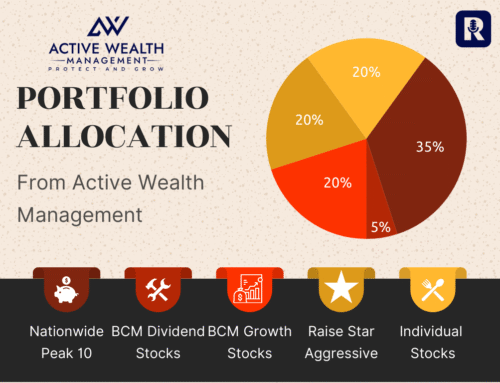

Here’s a modern blueprint we use with many clients:

A new 60/40—60% in diversified, low-cost ETFs/stocks for growth, and 40% in Fixed Indexed Annuities (FIAs) with highly rated insurers to create protected growth potential and lifetime income options. Done right, this structure aims to minimize risk, tame sequence-of-returns risk, and simplify fees, while giving you flexible, tax-efficient ways to draw income.

Below is your step-by-step guide to building that kind of fully diversified portfolio—and why it’s better aligned with today’s realities.

Why the “Old” 60/40 Isn’t Enough Anymore

1) It was designed in another era.

Markowitz’s work (1952) explained how blending assets reduces volatility for a given level of return—the “efficient frontier.” It was groundbreaking, and he earned a Nobel Prize for it. But what made sense when bond yields were high and inflation tame has been stress-tested in modern markets. (NobelPrize.org)

2) Bonds now carry meaningful interest-rate risk—recently exposed.

When rates rise, bond prices fall. In 2022, the U.S. bond market (Bloomberg U.S. Aggregate) fell roughly 13%, one of its worst years on record—right when investors expected bonds to “offset” stock declines. Meanwhile, a traditional 60/40 had one of its toughest years in decades, validating concerns that the classic mix can under-deliver just when retirees need it most. (Kavar Capital Partners, Morningstar)

3) Retirees face “sequence-of-returns” risk.

Losses in the first years of retirement can permanently dent lifetime income because you’re withdrawing while the portfolio is down. Research shows adding guaranteed-income tools can lower the risk of outliving savings compared to investments-only strategies. (InvestmentNews)

The lesson: bonds still have a role, but they’re not the only—or even the best—tool for the “safe” side of a retiree’s plan. You deserve something that protects principal, can credit market-linked gains, and can translate into paychecks for life.

The “New 60/40”: Growth + Protected Income

60%: Broad, Low-Cost ETFs and Stocks for Growth

For the growth sleeve, keep things diversified and inexpensive:

- Core U.S. equity: a total-market or S&P 500 ETF.

- International developed + emerging markets for global breadth.

- Small-cap and/or quality/value tilts (modestly) to smooth the ride.

- Consider real assets (REITs or a diversified real-assets ETF) as an inflation hedge.

Why low cost? Because fees are one of the strongest predictors of fund success. Morningstar’s long-running research shows lower expense ratios generally lead to better odds of outperformance versus high-fee peers. (Morningstar)

Implementation tips

- Favor ETFs with rock-bottom expense ratios.

- Rebalance at least annually or by tolerance bands (e.g., ±5%).

- Use tax-efficient ETFs in taxable accounts; place income-heavy holdings (like higher-yield bonds if you keep them) in IRAs when possible.

- Keep a year of cash needs in cash/T-Bills to avoid selling equities during a downturn.

40%: Fixed Indexed Annuities (FIAs) for Protected Growth Potential + Lifetime Income

FIAs are insurance products that protect principal (when you follow contract terms), link interest credits to an index (subject to caps/participation/spreads), and can add lifetime income riders. They’re not direct stock investments; you don’t lose money to market drops inside the FIA’s crediting formula, but your upside is limited by the contract’s terms. Guarantees are backed by the claims-paying ability of the issuing insurer. (NAIC, Investor)

Why FIAs in the new 60/40?

- Principal protection from market downturns (subject to contract rules).

- Market-linked growth potential via index crediting.

- Optional lifetime income riders to create paychecks you can’t outlive.

- Behavioral benefits—less panic during volatility, better adherence to your plan.

- Potential fee savings: if you previously paid asset-based advisory fees, allocating 40% to FIAs often eliminates AUM fees on that portion (advisors may be paid by the insurer instead), which can materially reduce your overall fee drag. (Fees and compensation structures vary by firm; ask your advisor.)

Important: FIAs vary widely. Read rate sheets and disclosures. Some linked indices are “excess return” indexes that deduct a notional cost, so their performance can be lower than a total-return version. Understand caps, participation rates, spreads, surrender periods, free-withdrawal features, and rider costs before you buy.

A Real-World Example: Nationwide Peak® 10 FIA

One carrier many investors evaluate is Nationwide. As of the August 1, 2025 rate sheet for states including Georgia, the Nationwide Peak® 10 shows:

- Up to 310% participation (two-year term) on the BNP Paribas Global H-Factor Index, depending on the account option and premium size (e.g., ≥$100k).

- Two-year point-to-point crediting options and other index choices.

- Standard surrender schedule typical of 10-year FIAs.

(Rates vary by state, premium, and change over time; always check current materials.)

Peak 10 also offers an optional Bonus Income+ Rider that adds a 25% immediate credit to the Income Benefit Base and then credits 8% simple interest to that income base for 10 years (rider fee applies and features vary by state). Note: the 25% credit applies to the income base (not the cash account value). Read the product profile and discuss with an advisor. (Nationwide)

Bottom line: FIAs like Peak 10 can provide protected growth potential plus a clear path to lifetime income. They’re not “too good to be true”—they’re insurance contracts with trade-offs (upside limits, surrender periods, rider fees) designed to offload market and longevity risks to an insurer. (FINRA)

Beyond Stocks and FIAs: Rounding Out True Diversification

A fully diversified retirement plan isn’t just “a basket of tickers.” Consider a mix across assets, income sources, and tax buckets.

Multi-Year Guaranteed Annuities (MYGAs)

Think of MYGAs as the CDs of insurance—guaranteed rates for multi-year terms, tax-deferred growth, and typically higher rates than many bank CDs (compare both). Current resources show 6-year MYGA rates commonly in the ~6.2%–6.6% range, depending on the insurer and state (rates change often). Interest defers until withdrawal or surrender, which can be tax-efficient for some households. Always compare guarantees, free-withdrawal provisions, and insurer ratings. (NAIC, nationwidefinancial.com)

Real Estate (Selectively)

Rental real estate can add income and diversification but brings illiquidity, concentration, and management burden. If you pursue this, keep it a controlled slice of the plan and stress-test cash flows.

Structured-Note Ladder (Optional and Modest at 5- 10% of the portfolio)

Some retirees like a ladder of five structured notes (e.g., issued by five different banks over five consecutive months, with varied index start dates) to diversify issuer and timing risk. These can provide targeted outcomes (buffers, coupons), but terms are complex and principal can be at risk; liquidity is limited and credit risk of the issuer applies. For many investors, buffered outcome ETFs provide similar payoff shapes with more transparency and liquidity. Review SEC/FINRA risk bulletins carefully before buying. (Investor, FINRA)

Maximize Your Social Security—the Foundation Layer

Social Security is your inflation-adjusted lifetime income floor. Getting the claiming decision right can be worth six figures over a lifetime. Delaying benefits past your Full Retirement Age increases your benefit—up to age 70—via “Delayed Retirement Credits” (roughly 8% per year if born 1943 or later). Spousal benefits can be up to 50% of the worker’s FRA benefit when claimed at the spouse’s FRA (earlier claims are reduced). Rules are intricate—coordination matters. (Social Security)

As a Registered Social Security Analyst (RSSA), I help couples choose a claiming strategy that fits their overall retirement plan and tax picture. Integrating Social Security with your FIA income and portfolio withdrawals is one of the highest-leverage planning moves you can make.

Diversify by Tax Bucket, Too

Retirement security isn’t only about what you own—it’s about where you own it for taxes:

- Taxable (brokerage)

- Tax-deferred (Traditional IRA/401(k))

- Tax-free (Roth)

Consider a strategic Roth ladder conversion—moving portions of a Traditional IRA to a Roth IRA over several years. Conversions are taxed as ordinary income in the year of conversion, but future Roth growth and qualified withdrawals are tax-free. Whenever possible, pay the conversion tax with taxable-account dollars, not IRA dollars, to keep more money compounding inside the Roth. (Mind brackets, Medicare IRMAA, deductions/credits.) (IRS, Schwab Brokerage)

Tax law evolves; coordinate with your CPA each year.

Putting It All Together: A Sample “New 60/40” Plan

Below is an illustrative structure (not individualized advice). The exact mix, products, and riders should be tailored to your age, risk tolerance, income needs, and tax situation.

Growth (60%)

- 30% U.S. core equity ETF

- 15% International developed ETF

- 5% Emerging markets ETF

- 5% U.S. small-cap or quality/value tilt

- 5% Real assets/REITs ETF

Protected Income & Stability (40%)

- 25–35% FIAs (e.g., a contract like Nationwide Peak® 10) used for protected accumulation and to secure a future lifetime income stream (with or without an income rider, based on need). The rider route exchanges a fee for guaranteed payout features; the no-rider route maximizes accumulation flexibility.

- 0–15% MYGA(s) to lock in multi-year guaranteed rates for mid-term needs or pre-retirement “bridge” years.

Why it works together

- The 60% growth sleeve captures long-term equity premium with low fees (a key performance driver). (Morningstar)

- The 40% FIA/MYGA sleeve reduces volatility, protects principal (per contract terms), and builds guaranteed income options that lower sequence-of-returns risk when withdrawals begin. (InvestmentNews)

- Coordinating Social Security with FIA income and tax-smart withdrawals helps stabilize taxes and extend portfolio longevity. (Social Security)

Risk, Costs, and Due Diligence—What to Check

For ETFs/Stocks

- Expense ratios (lower is better, all else equal). (Morningstar)

- Tracking error, liquidity, and diversification.

- A written rebalancing policy.

For FIAs/MYGAs

- Insurer ratings (A.M. Best, S&P, Moody’s).

- Surrender schedule, MVA, and free-withdrawal provisions.

- Crediting method (caps, participation, spreads; 1-year vs 2-year terms). Note that some linked “excess return” indexes deduct notional costs.

- Rider costs and features (if adding income riders).

- State-specific disclosures; read the NAIC Buyer’s Guide. (NAIC)

- Understand that indexed annuities are complex; review SEC/FINRA investor bulletins before purchase. (Investor, FINRA)

Common Questions

“Can FIAs really replace the bond portion?”

They can replace part of it for many retirees, because they protect principal, limit downside, and can create contractual income. Unlike traditional bonds, FIAs don’t fall in value when interest rates rise (though surrender charges apply if you exit early). The trade-off: your upside is limited by contract terms, and income riders cost money. Read carefully and compare options. (NAIC)

“What about fees?”

- Low-cost ETFs keep ongoing expenses tiny in your growth sleeve. (Morningstar)

- FIAs don’t have expense ratios like funds; costs show up in crediting limits and any optional rider fees. Many advisors do not charge AUM fees on annuity assets—so moving ~40% into FIAs can eliminate AUM fees on that portion, reducing total portfolio-level fees. Verify how your advisor is compensated.

“Will I miss out on equity dividends inside an FIA?”

Yes—FIA index crediting typically excludes dividends. Your ETFs in the 60% sleeve continue to capture dividends.

“What if I still want bonds?”

Totally fine. Some clients keep a small core bond allocation for liquidity and rebalancing. Just size it modestly and keep duration in check. The key is you’re no longer relying on bonds to be your only “safety” lever—your FIAs and MYGAs help share that job.

An Action Plan You Can Follow

- Define your income floor.

Add up Social Security (optimize it!) plus pensions and any rental income. Fill the gap with FIA lifetime income or planned annuitization, then layer withdrawals from your portfolio. (Social Security) - Build the growth sleeve (60%).

Choose 4–6 low-cost ETFs, set drift bands, and calendar a semiannual check-in. - Select the protected sleeve (up to 40%).

Compare FIAs (insurer ratings, crediting choices, rider needs) and MYGAs (terms and rates). If evaluating Nationwide Peak® 10, confirm current rate sheet and whether an income rider fits your needs. - Map a tax strategy.

Evaluate a Roth conversion ladder (pay taxes from taxable accounts), draw-down order, and bracket management. Coordinate with your CPA annually. (IRS, Schwab Brokerage) - Document the plan.

Put your Withdrawal Policy Statement and Rebalancing Rules in writing so you can follow the plan calmly through volatility.

Disclosures You Should Expect (and Want)

- FIAs/MYGAs are insurance products, not FDIC-insured, and all guarantees depend on the claims-paying ability of the insurer. Surrender charges and MVAs may apply to excess withdrawals during the surrender period. Read the Buyer’s Guide and contract carefully. (NAIC)

- Indexed annuities do not directly invest in an index; credited interest is limited by caps/participation/spreads and often uses excess-return indexes that deduct notional charges.

- Structured notes involve issuer credit risk, illiquidity, and potential principal loss; many retirees are better served with simpler tools. (Investor)

- This article is educational, not individualized tax, legal, or investment advice.

Let’s Build Your Plan

If you want help building a new 60/40—60% diversified, low-cost ETFs/stocks and 40% protected income using Fixed Indexed Annuities—I’m here to help. As an RSSA and fiduciary advisor, I’ll also help you maximize Social Security, coordinate a Roth conversion strategy, and reduce unnecessary fees where possible.

Call: 770-685-1777

Email: ford@activewealth.com

Listen: Retirement Results on AM 920 The Answer, WDUN in Gainesville, or anywhere you get podcasts. Visit RetirementResults.com.

About Ford Stokes, RSSA®, MBA

Ford Stokes is a fiduciary financial advisor, Registered Social Security Analyst (RSSA®), and host of the Retirement Results radio show and podcast. He is the author of The Smart Retirement Plan, Annuity 360, and Taxes Are on Sale. Ford and his team help pre-retirees and retirees design income-first, low-volatility retirement strategies that integrate Social Security optimization, protected-income solutions like fixed indexed annuities, low-cost ETF portfolios, and tax-smart withdrawal plans.

Contact: 770-685-1777 | ford@activewealth.com

Web: ActiveWealth.com | RetirementResults.com

Key Sources & Further Reading

- Harry Markowitz & MPT background; Nobel recognition. (NobelPrize.org)

- 60/40 stress under rising rates; 2022 as a pivotal year for bonds and balanced portfolios. (Morningstar, Kavar Capital Partners)

- Expense ratios as a strong predictor of fund success (Morningstar). (Morningstar)

- Indexed annuities—consumer/regulatory guidance (NAIC, SEC). (NAIC, Investor)

- Nationwide Peak® 10: current rate sheet (including up to 310% participation on BNPP Global H-Factor, two-year term) and product page (Income Base 25% credit + 8% simple roll-up rider). (Nationwide)

- MYGA rate context (check current rates; they change frequently). (NAIC, nationwidefinancial.com)

- Sequence-of-returns risk and the role of annuities in retirement income. (InvestmentNews)

- Social Security: Delayed Retirement Credits and spousal benefit basics. (Social Security)

- Roth conversions: tax treatment and the benefit of paying taxes with taxable funds, not IRA funds. (IRS, Schwab Brokerage)

If you’d like, I can tailor this framework to your specific situation and model the income plan, tax brackets, and Social Security timing for you and your spouse.