By Ford Stokes, RSSA®, MBA

Published on ActiveWealth.com and RetirementResults.com

On July 4, 2025, a landmark piece of legislation — Section 70106 of H.R. 1, known as the “Big Beautiful Bill” — was signed into law by President Trump. While the bill brought exciting tax relief provisions for retirees, such as a permanent $15 million estate and gift tax exemption and deductions tailored to older Americans, it also introduced new challenges for Roth ladder conversions.

Renowned retirement tax expert Ed Slott warns that Roth conversions have become more complex due to extensions of the Tax Cuts and Jobs Act (TCJA) and new income-based deduction thresholds. For retirees, the Roth ladder conversion — once a go-to strategy for minimizing future taxes — now carries the risk of accidentally triggering phaseouts of valuable tax deductions.

Let’s break down why this powerful tax strategy must now be carefully coordinated with your overall income and tax situation — or it could cost you dearly.

🔍 What Is a Roth Ladder Conversion?

A Roth ladder conversion involves gradually converting portions of a traditional IRA or 401(k) to a Roth IRA over several years. This “laddering” allows retirees to:

- Spread out tax liability over time

- Avoid Required Minimum Distributions (RMDs) from the converted amount

- Enjoy tax-free withdrawals in retirement

- Potentially lower future taxes for heirs

Before 2025, Roth ladder conversions were often recommended without concern for their broader tax impact. But the “Big Beautiful Bill” changed the playing field, introducing income thresholds that can disqualify you from new deductions if you aren’t careful.

⚠️ How the Big Beautiful Bill Complicates Roth Conversions

The new law introduced generous deductions for retirees — but with strings attached. These tax breaks phase out based on adjusted gross income (AGI), which means that a large Roth conversion could unintentionally eliminate eligibility for other valuable tax benefits.

Let’s explore the most important deductions and how Roth conversions could affect them:

🧓 The $6,000 Senior Deduction – Per Person

The new law includes a $6,000 annual tax deduction for individuals aged 65 and older. For married couples, that’s $12,000 in total deductions — a significant savings.

However, this deduction begins to phase out when income exceeds:

- $75,000 for individuals

- $150,000 for married couples filing jointly

🔎 Example:

John and Susan, both 67, plan to convert $100,000 from their traditional IRA to a Roth. Their other taxable income is $80,000.

After the conversion, their total AGI hits $180,000, which is $30,000 over the limit.

Result: They lose the entire $12,000 deduction ($6,000 each), potentially increasing their tax liability by up to $2,640 if they’re in the 22% tax bracket.

That’s a steep price to pay for a poorly timed conversion.

🧾 The Expanded SALT Deduction

The “Big Beautiful Bill” also increased the State and Local Tax (SALT) deduction cap to $50,000 per household, which is a major benefit for retirees in high-tax states like California, New York, New Jersey, and Illinois.

But there’s a catch:

- The deduction starts phasing out at $500,000 of AGI

- It’s completely eliminated above $600,000

🔎 Example:

A retiree in New Jersey has $450,000 in AGI and decides to convert $200,000 to a Roth IRA.

New AGI = $650,000 → above the cutoff.

Result: They lose the entire $50,000 SALT deduction, which may have saved $10,000–$15,000 in taxes depending on their tax rate.

In this scenario, the Roth conversion backfires and creates a significant tax penalty rather than a long-term advantage.

🏢 Qualified Business Income (QBI) Deduction

The 20% deduction for Qualified Business Income (QBI) — originally part of the TCJA — has been extended under the new law. It’s a boon for retirees who:

- Consult

- Freelance

- Own rental property

- Run part-time businesses

But it’s also income-sensitive, with phaseouts starting at:

- $191,950 for single filers

- $383,900 for joint filers (2025 figures)

⚠️ Roth conversions don’t count as QBI — but they do count toward your total AGI, which is used to determine eligibility for the QBI deduction.

🔎 Example:

Karen, age 66, has $180,000 in self-employment and rental income. She plans to convert $150,000 from her IRA.

New AGI = $330,000 → still under the phaseout limit, but only barely.

If she converted even $60,000 more, she’d start to lose the 20% QBI deduction, costing her thousands in lost savings.

🧠 Ed Slott’s Warning: Think Holistically

Retirement tax expert Ed Slott emphasizes that Roth conversions are no longer a standalone tactic. They must now be viewed in the broader context of your:

- Total taxable income

- Deduction phaseouts

- Medicare IRMAA brackets

- Social Security taxation

- Legacy and estate planning goals

“If you ignore how a Roth conversion affects your other deductions, it’s like trying to drive with one eye closed. You might get where you’re going — or you might hit a wall.” — Ed Slott

✅ How to Do Roth Ladder Conversions Right in 2025 and Beyond

Here’s how retirees can still use Roth conversions without sabotaging their tax situation:

✅ 1. Work with a Fiduciary Advisor

This is no time for guesswork. A fiduciary financial advisor will:

- Model your tax bracket year-by-year

- Help avoid deduction phaseouts

- Align your Roth conversion plan with Social Security and Medicare thresholds

- Integrate estate and legacy planning strategies

At Active Wealth Management, we offer complimentary Roth conversion roadmaps for qualified clients, using real-time tax data and future projections. Feel free to call our office anytime at 770-685-1777 or send an email to ford@activewealth.com.

✅ 2. Convert Just Enough Each Year

Use your annual Roth conversion like a measuring cup, not a fire hose. Consider:

- Filling the 12% or 22% tax bracket, but stopping before the 24% bracket

- Converting just enough to stay under $75K/$150K for the senior deduction

- Maintaining room for deductions and credits like QBI or SALT

This requires annual tax planning — not just a one-time decision.

✅ 3. Watch the Medicare IRMAA Brackets

Roth conversions affect your Modified Adjusted Gross Income (MAGI), which determines whether you pay Income-Related Monthly Adjustment Amounts (IRMAA) on Medicare Part B and D.

IRMAA surcharges can add $1,000–$5,000 per year in extra premiums.

Plan conversions to avoid tipping into a higher IRMAA bracket. For example:

- Stay under $194,000 MAGI (married) or $97,000 (single) to avoid the first surcharge

- Consider larger conversions before age 63, when IRMAA isn’t yet applied

✅ 4. Use Down Market Years Wisely

Bear markets are an excellent time for Roth conversions because:

- IRA values are lower = smaller tax bill on conversion

- Market recovery happens inside the Roth = tax-free growth

Just make sure the smaller market value doesn’t lure you into converting too much and pushing your income too high.

✅ 5. Use Charitable Tools to Offset Income

If you’re charitably inclined, consider:

- Qualified Charitable Distributions (QCDs) from IRAs to reduce RMDs

- Donor-Advised Funds (DAFs) to bunch deductions

- Gifting appreciated assets to reduce capital gains

These tools can counteract the taxable income bump from a Roth conversion.

📊 Case Study: Strategic Roth Ladder Conversion

Steve and Marcia, both 66, have $2.2 million in IRAs and $90,000/year in pension + Social Security.

They originally planned to convert $150,000/year over 10 years. But we ran the numbers:

- $150,000 would push them to $240,000 AGI

- They’d lose the $12,000 senior deduction

- They’d hit the Medicare IRMAA Tier 3

- They’d reduce their QBI deduction from Marcia’s rental property

- Their effective tax rate would hit 28.4% due to stacked impacts

Instead, we helped them:

- Convert just $75,000/year over 15 years

- Stay under IRMAA and deduction cliffs

- Maximize long-term tax-free Roth growth

- Save an estimated $63,000 in taxes and premiums over the next decade

🔐 Roth Conversions: Still a Smart Move — With Guardrails

Roth conversions remain one of the most powerful tools in retirement tax planning — but they must be executed with surgical precision in the post–2025 tax landscape.

Without strategic planning, you risk:

- Losing senior tax breaks

- Triggering IRMAA penalties

- Eliminating business income deductions

- Paying unnecessary taxes on Social Security

- Giving more to the IRS than you intended

🎁 Let Us Help You Create a Tax-Efficient Roth Strategy

At Active Wealth Management, we specialize in helping retirees:

- Avoid deduction phaseouts

- Maximize after-tax retirement income

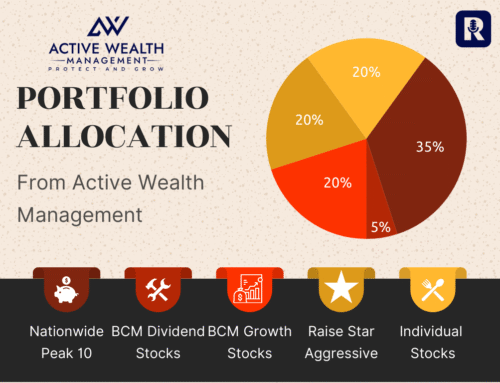

- Lower portfolio risk with guaranteed income annuities

- Optimize Roth conversions over time

Book your free $2,500 consultation now:

📞 1-888-814-0304

🌐 RetirementResults.com

📅 Schedule at: Calendly.com/fordstokes

Final Thought

Roth conversions can still unlock enormous value — but in 2025 and beyond, they demand care, precision, and a complete understanding of how today’s income decisions affect tomorrow’s tax future.

Don’t go it alone. Let’s build your tax-smart Roth ladder strategy — one careful step at a time.

Written by:

Ford Stokes, RSSA®, MBA

Founder & President, Active Wealth Management

Host of the Retirement Results Radio Show

Author of The Smart Retirement Plan and Annuity 360