Why Workers in Their 40s and 50s Should Consider Replacing Bonds with Fixed Indexed Annuities

Written by Ford Stokes, MBA, RSSA A Smarter Approach to Preserve Capital, Lock in Growth, and Generate Income Later As you enter your 40s and 50s, your retirement horizon is [...]

Three Smart Ways to De-Risk Your Portfolio: Why Fixed Indexed Annuities Are the New Bond Alternative

Protect your savings, grow your wealth, and secure income you can’t outlive. The Market Has Changed — Your “Safe Money” Strategy Should Too If you’re nearing or already in retirement, [...]

Nov. 10th & 17th: Maximize SS and Retirement Seminar: Hampton Park Library, 6:00 PM ET

We invite you to register via this link: http://www.retirementworkshop.info/stokes for our November 10th and 17th at 6:00 PM ET, "Maximize Your Social Security Benefits, Wealth and Retirement Income Seminar" at [...]

Why Younger Professionals Are Investing in Fixed Indexed Annuities and Roth 401(k)s to Secure Their Retirement

Retirement planning used to be something people thought about in their 50s or 60s. But today, a growing number of younger professionals—those in their 30s and 40s—are taking a different [...]

Georgia Residents Gain Access to Expert Social Security Guidance Through RSSA® Network

PRESS RELEASE FOR IMMEDIATE RELEASE Georgia Residents Gain Access to Expert Social Security Guidance Through RSSA® Network Ford Stokes, RSSA®, MBA Among Just 24 Certified Analysts in Georgia ATLANTA, GA [...]

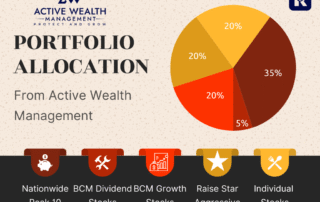

A Smart Example of Portfolio Diversification and Allocation with Active Wealth Management

At Active Wealth Management, we believe that smart retirement planning and portfolio construction must be rooted in diversification, growth potential, risk management, and guaranteed income strategies. Here’s an example of [...]

Jump Start Your Retirement Catch-Up Right After Labor Day

A Fresh Start for Your Financial Future Labor Day marks more than just the unofficial end of summer—it’s also the perfect time to hit reset and refocus on your financial [...]

Happy 90th Birthday, Social Security: Why Now is the Time for Strategic Retirement Planning

Happy 90th Birthday, Social Security: Why Now is the Time for Strategic Retirement Planning August 14, 2025 marked a historic milestone: Social Security turned 90 years old. Since President Franklin [...]

The Fully-Diversified Retirement Portfolio for Today: A Smarter 60/40 (60% Stocks/ETFs + 40% Fixed Indexed Annuities)

If you’re nearing retirement (or already there), you don’t just need growth—you need reliable income, lower volatility, and a plan that holds up when markets don’t. The classic “60/40” portfolio—60% [...]

How Wirehouse Stockbrokers Got It Wrong About Annuities: A Clearer Path to Retirement Security

In recent years, Wirehouse stockbrokers have consistently been critical of annuities, particularly fixed indexed annuities (FIAs). The narrative they present paints annuities as costly, inefficient, and unsuitable for modern investors. [...]